Saturday, April 09, 2005

The Drew Out Clause as a Financial Option

I was reading an article dated 4/4/05 in the Fourth Outfielder where J. D. Drew's opt-out clause is discussed in comparison to Aramis Ramirez's similar clause. The article basically states that Drew's opt-out clause is nowhere near as bad as Aramis'. It seems as though that there was quite a disagreement between the readers on which is worse. (I am comment #29, by the way, dated 4/6/05.) Studes also commented on the article and gave his own thoughts in The Hardball Times on 4/7/05.

I would like to expand on what I stated in the Fourth Outfielder: the player opt-out clause has a significant value, and its value can be estimated.

To me, a player opt-out clause is similar to a financial option, which is a product traded in the derivative market, my former field of study and work. (Many thanks to Prof. Cox for the pleasant naps during his option theory class) Here is a quick summary.

http://www.riskglossary.com/articles/option.htm

After two years in LA, Drew has the right to void the last three years ($33 mil) of his contract if he believes that he can get a higher offer in the open market. Logic would dictate that the option would not be exercised otherwise. In effect, Drew has a "European call option" with a strike price of $33 million.

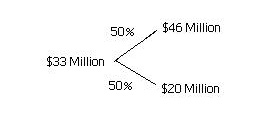

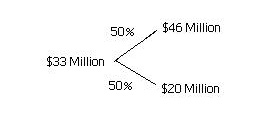

For the sake of simplicity, let's say there are two 50/50 possible scenarios in two years: Drew has played marvelously for two years and his market value has climbed to $46 million, or he has been ineffective/injured and his value has sunk to $20 million.

A Simple Binomial Option Model

If Drew signs a contract for $46 million in the open market, then he will have pocketed an additional $13 million. If his worth drops to $20 million, Drew still earns $33 million in LA and loses nothing.

What is the value of this option? Let's assume that the annual interest rate is about 4%. I'm going to skip a lot of numbers and say that this option is worth about $7 million, or $7.24 million to be exact.

If we were to use a trinomial model - say there is a 33%/33%/33% chance of being a $46 mil/$33/$20 player - the option is worth about $5 million. Not as much, but still significant.

I realize that these values are based on an extremely simple model, but the numbers are still significant. (A better way would be to determine a historical distribution for contract fluctuations amongst similar players and then value the option, in spirit with a Black-Scholes model.) The point I want to make is this: a five year $55 million contract with a player opt-out clause after two years is about equivalent to a five year $55 million contract sans the clause and WITH AN ADDITIONAL $5 TO $7 MILLION UPFRONT. Put another way, this is in essense a 5 year contract worth about $62 million, with $17 to $18 million in the first year.

(drum roll....)

That's essentially Beltre's contract from Seattle. To refresh everyone's memory, Beltre turned down the Dodgers' six year $60 million offer for Seattle's front-loaded five year $64 million offer. ($17 million or so in the first year) Depodesta then signed Drew to replace Beltre's production in the lineup. Hindsight is 20/20, but Depodesta lost out on Beltre and replaced him by signing Drew, overpaying to a point where the $ amounts were, in essense, similar.

No wonder Scott Boras was reportedly cautious during Beltre's Seattle press conference when asked about the Dodgers. I wouldn't be surprised if he probably had this scenario lined up all along - take Beltre elsewhere, offer Drew and his "Moneyball" numbers to LA. I believe that Depodesta got taken here. Love him or hate him, Boras is pretty good.

I would like to expand on what I stated in the Fourth Outfielder: the player opt-out clause has a significant value, and its value can be estimated.

To me, a player opt-out clause is similar to a financial option, which is a product traded in the derivative market, my former field of study and work. (Many thanks to Prof. Cox for the pleasant naps during his option theory class) Here is a quick summary.

http://www.riskglossary.com/articles/option.htm

After two years in LA, Drew has the right to void the last three years ($33 mil) of his contract if he believes that he can get a higher offer in the open market. Logic would dictate that the option would not be exercised otherwise. In effect, Drew has a "European call option" with a strike price of $33 million.

For the sake of simplicity, let's say there are two 50/50 possible scenarios in two years: Drew has played marvelously for two years and his market value has climbed to $46 million, or he has been ineffective/injured and his value has sunk to $20 million.

A Simple Binomial Option Model

If Drew signs a contract for $46 million in the open market, then he will have pocketed an additional $13 million. If his worth drops to $20 million, Drew still earns $33 million in LA and loses nothing.

What is the value of this option? Let's assume that the annual interest rate is about 4%. I'm going to skip a lot of numbers and say that this option is worth about $7 million, or $7.24 million to be exact.

If we were to use a trinomial model - say there is a 33%/33%/33% chance of being a $46 mil/$33/$20 player - the option is worth about $5 million. Not as much, but still significant.

I realize that these values are based on an extremely simple model, but the numbers are still significant. (A better way would be to determine a historical distribution for contract fluctuations amongst similar players and then value the option, in spirit with a Black-Scholes model.) The point I want to make is this: a five year $55 million contract with a player opt-out clause after two years is about equivalent to a five year $55 million contract sans the clause and WITH AN ADDITIONAL $5 TO $7 MILLION UPFRONT. Put another way, this is in essense a 5 year contract worth about $62 million, with $17 to $18 million in the first year.

That's essentially Beltre's contract from Seattle. To refresh everyone's memory, Beltre turned down the Dodgers' six year $60 million offer for Seattle's front-loaded five year $64 million offer. ($17 million or so in the first year) Depodesta then signed Drew to replace Beltre's production in the lineup. Hindsight is 20/20, but Depodesta lost out on Beltre and replaced him by signing Drew, overpaying to a point where the $ amounts were, in essense, similar.

No wonder Scott Boras was reportedly cautious during Beltre's Seattle press conference when asked about the Dodgers. I wouldn't be surprised if he probably had this scenario lined up all along - take Beltre elsewhere, offer Drew and his "Moneyball" numbers to LA. I believe that Depodesta got taken here. Love him or hate him, Boras is pretty good.